Craig James' pro-BC Liberal bias in the Harmonized Sales Tax battle with Fight HST was the precursor to current allegations of bias and financial improprieties. And it could lead to a BC NDP win in Nanaimo by-election

|

| Suspended BC Legislature Clerk Craig James - CBC screenshot |

Monday January 28, 2019

By Bill Tieleman

“Craig James simply moved the goal posts in the middle of the game. It was astounding. No one in such a critically impartial position had ever done anything like it before, and it shook the foundation of that important office’s credibility to the ground.”

-->

- Ex-BC Premier Bill Vander Zalm on Craig James role as then-Chief Electoral Officer in changing recall rules after an application was made by Fight HST, in his book HST & The People For Democracy, p. 112, 2013

When now suspended BC Legislature Clerk Craig James was appointed acting Chief Electoral Officer at Elections BC in 2010, those working to eliminate the Harmonized Sales Tax imposed by the BC Liberal government were very concerned.

The reason Fight HST was anxious?

Because then-Premier Gordon Campbell declined to extend the appointment of respected and neutral Chief Elections Officer Harry Neufeld by three months to finish off the HST Citizens Initiative procedure and instead made James Acting CEO as a temporary appointment, which avoided seeking the approval of a bi-partisan Legislative committee.

Those suspicions were proven in spades in short order, as James made a series of decisions that were prejudicial to Fight HST, the grassroots group led by ex-Social Credit Premier Bill Vander Zalm, where I served as strategist throughout.

Speaker Darryl Plecas drops a bombshell on Craig James

And the recent revelations in Speaker Darryl Plecas’ bombshell report on alleged financial wrongdoing and expenses mismanagement about James’ surprising and extensive connections to the BC Liberals shed new light on his past role at Elections BC during the HST battle.

What’s more, with the critical Nanaimo provincial by-election pending on Wednesday January 30, the past actions of James are coming home to roost for the BC Liberals at the absolutely worst time possible for them.

A win by novice BC Liberal candidate Tony Harris would create a tie in the Legislature, with the combined NDP government MLAs and the three Green MLAs supporting the government at 43 seats and the opposition with an equal 43, leaving independent speaker Plecas to break any ties.

And that likely would lead to a provincial election in 2019, given the difficulty of managing the Legislature’s business with an extremely tense and narrow margin.

Stunning information about James’s close ties to BC Liberals hurts in Nanaimo

But the stunning emergence of new information from Plecas about James’ close and ongoing ties with the BC Liberals – including taxpayer-paid visits with former BC Premier Christy Clark after she had left office; with ex-BC Liberal Speaker Bill Barisov in the Okanagan; and with former BC Liberal Attorney General Geoff Plant – a key player in the HST court battles – means the BC Liberals face a lot of tough questions.

And Nanaimo voters get the first chance to tell them they want answers, not another BC Liberal MLA in the Legislature and another election that could let them return to power.

That likely spells bad news for Harris, son of the late Tom Harris – a well-known Nanaimo car dealer – and also for BC Green Party candidate Michele Ney, daughter of the late Frank Ney – a longtime colourful Nanaimo mayor and one-term Socred MLA.

But it should help BC NDP candidate Sheila Malcolmson – the former NDP Member of Parliament for Nanaimo-Ladysmith – win the seat vacated when veteran MLA Leonard Krog resigned to win election as mayor of Nanaimo last fall. The NDP won it in 2017 with a very comfortable margin of over 3,800 votes.

As Andrew MacLeod wrote last week in The Tyee about James’ purported BC Liberal bias:

“Plecas said in his report he first heard the allegation that James was partisan from [also suspended Sergeant-at-Arms Gary] Lenz in the fall of 2017. ‘Mr. Lenz expressed the view that Mr. James was not impartial and that he was in fact very close with the BC Liberal Party... I determined to reserve judgment on that subject.”

He wrote that others shared the impression that James was partisan thanks to decisions he had made while acting as the chief electoral officer on an interim basis starting in 2010.”

MacLeod notes that of 39 trips James made between March 2017 and August 2018, 70 per cent were to current or former BC Liberal MLAs, including 14 meetings with Plant and three with Christy Clark after she was no longer premier.

Now it seems that the long arm of history is reaching out after Craig James as well as the BC Liberals, with the HST episode apparently one of the first but not last controversies James was involved with.

Bill Vander Zalm details Craig James’ role at Elections BC during HST battle

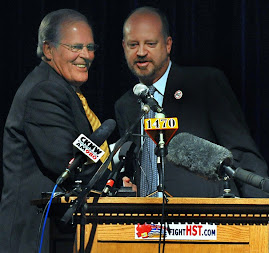

|

Fight HST leader Bill Vander Zalm and Fight HST strategist Bill Tieleman

at Citizens Initiative launch, April 2010 - Cassandra photo |

Vander Zalm details James’ role at Elections BC in his book on the HST battle that ultimately saw the hated tax extinguished through a provincial binding referendum after Fight HST launched the first and only successful Citizens Initiative petition – unique to BC in Canada – that garnered over 705,000 voter signatures in just 90 days in 2010.

“Gordon Campbell chose, what we immediately thought to be a [BC] Liberal friendly person, Legislative Clerk Craig James, to be the ‘Acting Chief Electoral Officer’. His appointment was said to be for a few weeks until they could find a permanent replacement. But it lasted over a year until the HST Petition and Referendum process had been completed,” Vander Zalm wrote.

In the summer of 2010, despite the success of the Citizens Initiative petition, James had ruled Elections BC would not proceed until a court application brought about by a big business coalition – trying to throw out the entire HST initiative – had been heard.

Fortunately, BC Supreme Court Chief Justice Robert Bauman was unconvinced by the legal arguments led by former Attorney General Plant and Peter Gall, a lawyer well-known and disliked in the labour movement for taking pro-employer cases at the Labour Relations Board, often to block certification drives.

Bauman overruled James and said Citizens Initiative petition was within both the letter and spirit of the law.

While that paved the way to the historic vote on the HST, Craig James was not yet done fighting Fight HST.

Recalling Craig James fighting the Fight HST recall campaign

With the BC Liberal government eventually agreeing to hold a binding referendum but delaying it until the summer of 2011, Fight HST attempted to force a much earlier vote by launching recall campaigns to remove some BC Liberal MLAs.

The first targeted was then cabinet minister and MLA Ida Chong in Oak Bay-Gordon Head, where local organizers for Fight HST were convinced they could succeed with a recall campaign starting in late November.

But three days after their recall applications was submitted, James ruled it invalid and rejected it.

Why? Because it had exceeded, James said, the 200-word maximum in the description of the recall application.

As Vander Zalm wrote in his book: “James said that the word ‘HST’ should have been written in full and counted as 3 words – ‘Harmonized Sales Tax’ – and ‘MLA’ as 5 words – ‘Member of the Legislative Assembly’. No, I’m not making this up.”

And in every reference to MLA or HST, not just the first.

But the stunning part wasn’t simply that James was being overly bureaucratic – it turned out he actually changed the Elections BC rules on acronyms – afterthe recall petition had been filed!

Rules changed by Craig James after recall application already filed

As the Globe and Mail reported: “Elections BC rejected a Fight HST recall application as too lengthy – but did so using rules that were drafted after it received the application.”

After heavy criticism in the media from Fight HST, the NDP and others, James issued a statement “explaining” his actions that was less than convincing.

James also then ordered that 150 recall canvassers who had signed up with an Elections BC form must refill and refile their applications, forcing organizers to go back to each person for a new signature.

Together these two moves by James knocked up to two weeks off the start of the recall campaign – pushing it much closer to the Christmas holidays, a period where canvassing would be almost impossible to conduct.

In the end the recall effort obtained over 10,000 signatures in 60 days – impressive in the circumstances but not the 40% needed to force a by-election.

However, BC politics has a strange karma that often comes back to haunt those who cross it.

James became the Legislature’s new clerk in 2011 over the objections of then-NDP leader Adrian Dix and then-house leader John Horgan, who said a full hiring procedure should have been conducted – leading the NDP to vote against James.

On Wednesday January 30, if the BC NDP are victorious in the Nanaimo by-election, they may have to thank Craig James helping secure their win, thanks to his past roles – including the by-election that never happened.

-->

Bill Tieleman is a former NDP strategist who owns West Star Communications, a strategy, consulting and government relations firm for over 20 years serving labour, business, non-profits and others.

Bill previously wrote a weekly political columnist for over 16 years, for The Tyee online magazine, the now-closed 24 Hours Vancouver newspaper and The Georgia Straight weekly. Email him at weststar@telus.net or see Twitter @BillTieleman or visit his blog.

.